Details of changes and the impact when components of equity are restated or applied retrospectively in accordance with the IAS/Ind-AS 8.Ĭomprehensive income is those income listed after the net income on the income statement.Details of comprehensive income for the accounting period.Reconciliation of the opening and closing balances of equity, describing the changes in detail.As per the IND AS, this statement of changes in equity is to be presented and it includes the following: Under Indian GAAP, there is no requirement for this statement however, Schedule III of the Companies Act 2013 requires such movement in shareholder’s equity to be presented as part of notes to accounts. However, this will not provide the details of the changes that have happened in the equity and for this purpose, this statement of changes in equity is required. This information can be obtained from the balance sheet of the entity. The difference between the assets and liabilities from one accounting period to the next will give you the movement in equity. The answer to certain tax and accounting issues is often highly dependent on the fact situation presented and your overall financial status.Why is the Statement of Changes in Equity Needed? While the concepts discussed herein are intended to help business owners understand general accounting concepts, always speak with a CPA regarding your particular financial situation. Therefore, the information available via this website and courses should not be considered current, complete or exhaustive, nor should you rely on such information for a particular course of conduct for an accounting or tax scenario. Tax and accounting rules and information change regularly. Reliance on any information provided on this site or courses is solely at your own risk.

Statement of changes in equity professional#

Accounting practices, tax laws, and regulations vary from jurisdiction to jurisdiction, so speak with a local accounting professional regarding your business. The content is not intended as advice for a specific accounting situation or as a substitute for professional advice from a licensed CPA.

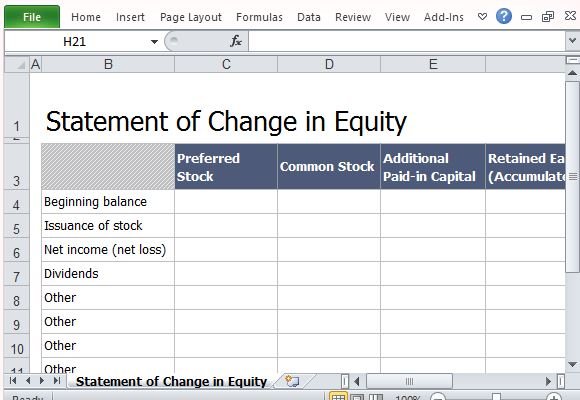

The content provided on and accompanying courses is intended for educational and informational purposes only to help business owners understand general accounting issues. Statement of Owners Equity in Larger CorporationsĪ Corporation issues ownership shares called Capital Stock - so it is common to see the Statement or Owners Equity be referred to as Statement of changes in Stockholder's Equity in bigger Corporations. In such cases, the reader of the Financial Statement can ascertain the changes to the equity accounts from the company profit (or loss) which can be seen in the Income Statement and any Ownership Contributions or Cash Dividends which is located in the Cash Flow from Financing Activities in the Statement of Cash Flows. Often times, many small and mid sized firms may even choose not to include a Statement of Owner's Equity. Less: Any Withdrawals taken by the Owners The Statement of Owners Equity follows a simple formula -Īdd: Any Additional Owner Contributions into the Business

They decrease by Owner Withdrawals, Dividend Distributions or Company Losses. They increase by Owner contributions and Company Profits. The Changes in Owner's Equity in smaller organizations can be rather simple and straightforward. Statement of Owner's Equity in Small and Mid Size Firms The Statement of Owner's Equity looks very different in Small and Mid Size Firms vs. (2) changes that result from changes in net income for the period, total comprehensive income, revaluation of fixed assets, changes in fair value of available for sale investments, etc. (1) changes that originate from transactions with the owners (shareholders) such as issue of new shares, payment of dividends, etc. The theory behind the Statement of Owners Equity is to reconcile the opening balances of equity accounts in a company with the closing balances and present this information to external users.īroadly, the two major types of changes that effect the Statement of Owners Equity are. Owner's Equity begins when capital is invested in the business by the owners and thereafter increased (or decreases) as profits (or losses) are made in the business.

0 kommentar(er)

0 kommentar(er)